Actuarial Valuations

We provide professional & high quality actuarial valuation services to employers.

We assist clients manage and prepare for the potential financial consequences of future unforeseeable events and help optimize impact on financial statements. Using scenario testing, we assist in making optimal financial decisions whilst maintaining regulatory compliance for reporting.

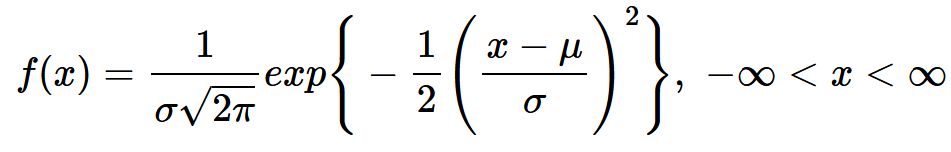

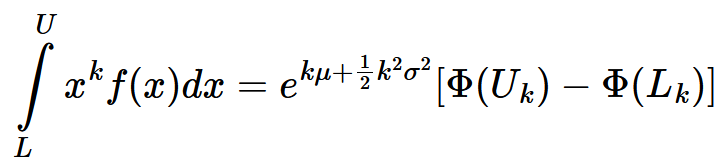

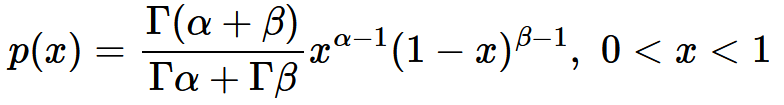

Our actuarial valuation process is fact-based and rigorously quantified using actuarial and statistical techniques. We ensure risk and uncertainty are fully evaluated and modeled in full depth. We provide credible documentation for internal book keeping and offer practical solutions to real-world problems.

Our actuarial process tests the resilience and robustness of financial decisions made in the past. We blend broad-based expertise with exclusive knowledge of specific risks, allowing us to provide independent, objective advice depending upon each client’s specific situation.

In terms of delivery, we have very short turn-around times. We work closely with client teams to make sure quality inputs are provided, helping us deliver in a timely and empathetic manner.

Our work with employers of different sizes and industries gives us a unique vantage point, allowing us to offer immense value at a fraction of its cost.

Our specialty areas include,

- Actuarial valuations of Gratuity, Privilege Leave, Sick Leave, Post Retirement Medical Benefit, and Defined Benefit Pension.

- Reporting as per IGAAP (Accounting Standard 15, Revised 2005), IFRS (International Accounting Standards 19, Revised 2011) and USGAAP (Accounting Standards Codification 175).

- Advisory for annual contributions towards funded plans.

- Mining of historic data to set realistic and long-term valuation assumptions.

- Back-testing of actuarial assumptions.

- Experience Analysis.

Non Life Insurance

We advise clients on rate adequacy, pricing scenarios, future planning, and consult on risk selection, trends, and market intelligence.

We work closely with clients so they can make well-informed decisions on all types of programs and new and existing products. Our clients’ pricing needs are always met our innovative expertise, and creative pricing solutions.

We have imbibed the adage: Data is the new oil. We understand clients’ existing data management process and help set smooth data pipelines with data pre-processing techniques. This enables a smoother actuarial workflow and reporting process.

Mastering data and data management are key areas of our expertise to ensure quality data for pricing and reserving purposes.

We specialize in harnessing data and unlocking its business value. We offer advanced business intelligence & analytics services. We mine your data, ask questions, predict outcomes, visualize results, and share through dashboards.

We understand, from our first-hand consulting experience, that reporting consumes significant amount of time, effort and energy. We build intuitive, adaptable, easy to implement, scalable and sustainable big data analytics solutions accelerating the velocity of decision making.

Given the business environment we are in today, it has never been more important to create a foundation of truth and relevancy to support better, faster decisions in a governed environment.

We help build customized KPI dashboards to act as a perfect tool for tracking metrics over comparable periods of time. Our dashboards are constantly evolving to deliver metrics with drill-down levels to help decode your data. We look at absolute value or indices, derive trends and compare actual experience with expected experience. This allows management reporting to be much more strategic in nature with diagnostics and correctives built in.

We offer customized solutions to best meet our clients’ budget and objectives.

Our areas of specialties include,

- Multiple lines and business segments

- Solvency II requirements

- Price/Cost/Profit Relationships

- Evaluation of Loss Ratios, Loss Development data

- Reserving and IBNR valuations

- Analysis of surplus

- Future claims cost projections

Managed Actuarial Services

We offer flexible staffing solutions for actuarial transformation for non-life and employee benefits processes. We offer an actuarial and statistical workforce, flexible in nature, trained to be a part of a global team.

We execute actuarial transformations to bolster implementation success, and as an integral element in the design of a revamped actuarial function that can deliver greater value to clients at a lower cost.

We take on a variety of tasks and processes within the actuarial function freeing up time for actuaries. We execute and support these tasks and processes to enable clients reduce costs, free and expand capacity, and gain access to capabilities in the most efficient and effective manner.

Our services span a broad spectrum of work to enable you to increase the value your actuarial organization delivers as part of your actuarial transformation.

- Actuarial modeling and reserve calculations

- Model Development

- Advanced Actuarial Analytics

- Pricing and Product Development

- Regulatory Reporting

Our staff augmentation services address seasonal demands and needs for specific skills. Our offerings include,

- Client-managed resources

- Client-driven processes and governance

- No service-level-agreements

- Capacity-based models.